| Introduction |

| Infrastructure Australia proposes national infrastructure priorities to inform Australian Government investment |

| Future investment considerations |

| List of sources |

Annual Budget Statement 2025

1 February 2025

Introduction

Infrastructure Australia is the Australian Government’s independent adviser on nationally significant infrastructure investment planning and prioritisation. Sectors within Infrastructure Australia’s remit comprise transport, energy, communications, water and social infrastructure.

Purpose of this statement

This document delivers on the requirement of section 5DB of the Infrastructure Australia Act 2008 that Infrastructure Australia must give to the Minister and table in both Houses of Parliament each financial year:

- An annual budget statement to inform the annual Commonwealth budget process on infrastructure investment; and

- An annual performance statement on the performance outcomes being achieved by states, territories and local government authorities in relation to the infrastructure investment program and existing project initiatives funded by the Commonwealth.

The Annual Budget Statement 2025

This second edition of the Annual Budget Statement includes:

- Proposed national infrastructure investment priorities, developed from Australian, state and territory plans and investments, and consultation with stakeholders.

- Considerations for infrastructure investment prioritisation and delivery in the short, medium and long term, including infrastructure market capacity constraints and reducing emissions from infrastructure.

Infrastructure Australia proposes national infrastructure priorities to inform Australian Government investment

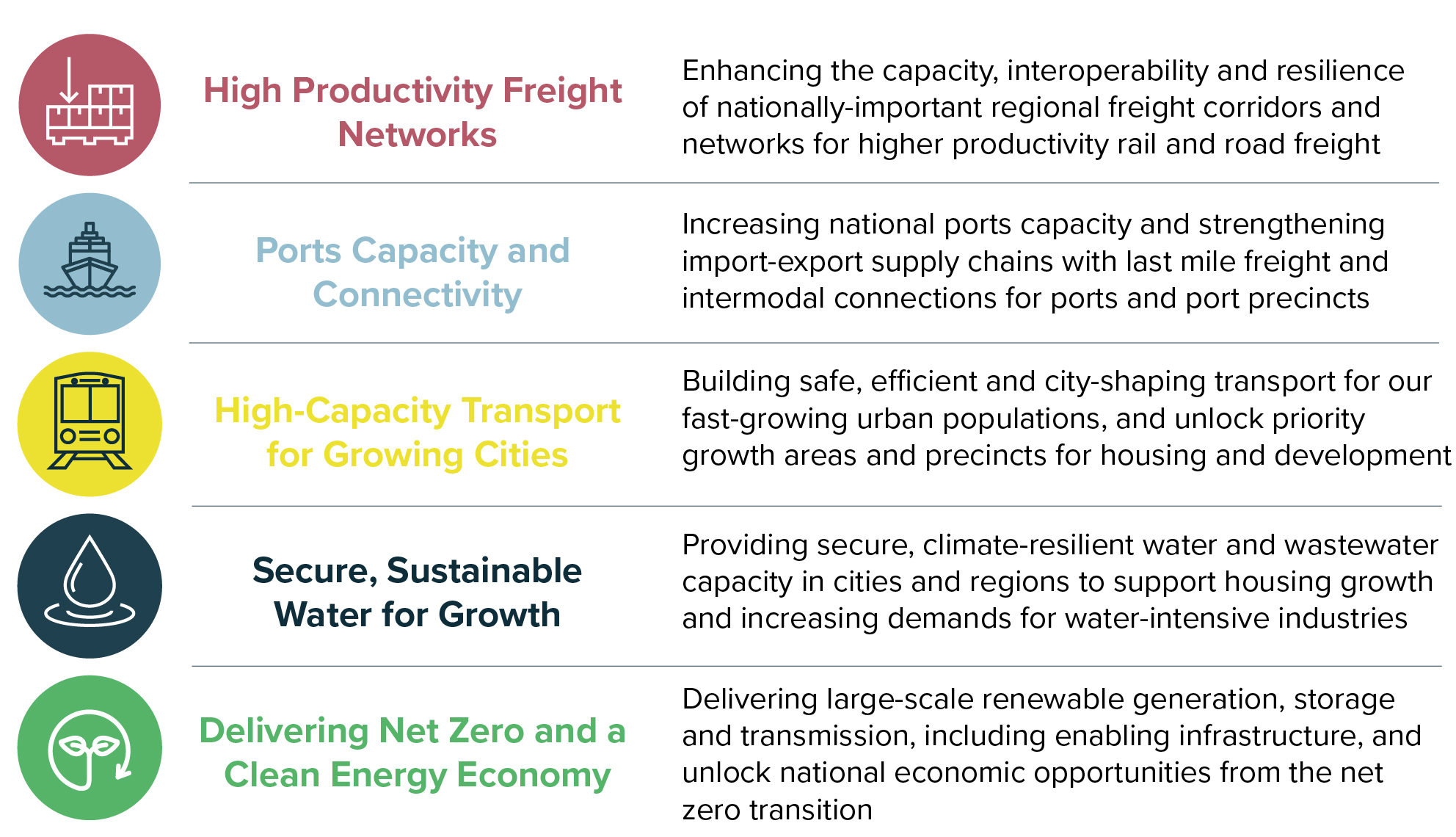

The national infrastructure priorities proposed represent Infrastructure Australia’s view of the current, most significant focus areas for infrastructure investment at a national level in the short, medium and long term. The priorities (in Figure 1 and discussed further below) address and support nationally significant infrastructure needs and opportunities and have been developed based on:

- Structured analysis of infrastructure issues, needs, gaps and priorities identified in recent published state and territory infrastructure strategies and plans

- Extensive engagement with jurisdictions on current and emerging priorities for infrastructure planning and delivery investment.

These national infrastructure priorities are not intended to be exhaustive. Infrastructure Australia also expects these national infrastructure investment priorities to evolve in future statements based on further engagement, updated analysis and as infrastructure investments progress.

Figure 1: Proposed national infrastructure investment priorities

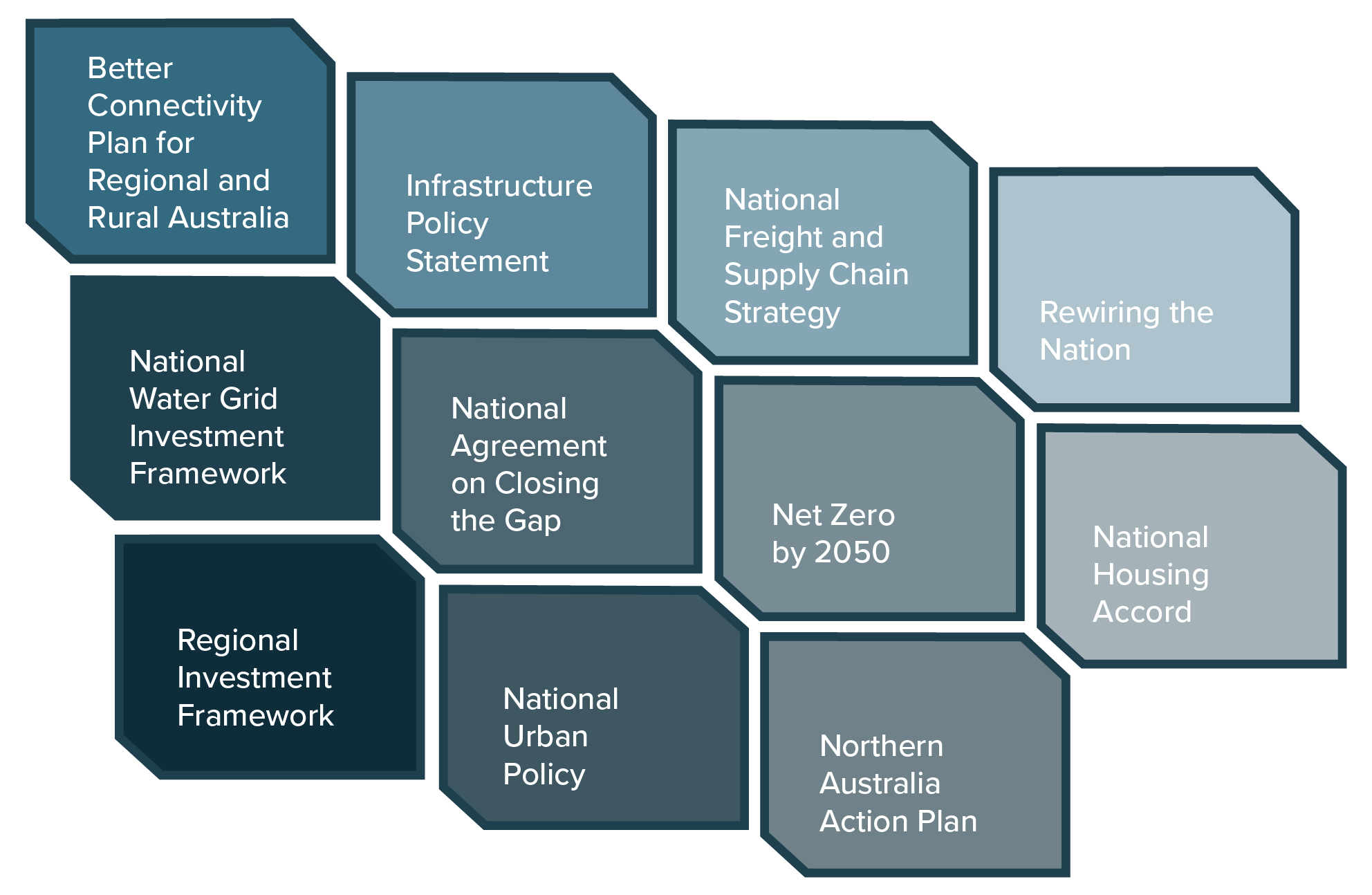

The priorities set out in this Annual Budget Statement support policies and initiatives of the Australian Government, including but not limited to those identified in Figure 2.

Figure 2: Examples of Australian Government policies and initiatives aligned to national priorities for infrastructure investment

Future investment considerations

This section highlights several critical considerations for the Australian Government when making new infrastructure investment decisions.

When considering new infrastructure investments, the Australian Government should continue to consider:

- Market capacity for both labour and materials, with a focus on:

- Existing and planned projects with similar and large material and labour needs – for example, mega projects and tunnelling projects, across different sectors.

- Existing and planned projects within a similar geographical area.

- Geographical limitations on material and labour supply, particularly in regional locations projected for significant demand growth.

- Engaging with jurisdictions to:

- Ensure an appropriate, sustainable balance of funding for nationally significant infrastructure between maintenance, renewal and investment in new infrastructure.

- Ensure that proposals brought forward adequately consider resilience issues and address current and future climate-related risks to infrastructure.

- Continue to embed consideration of emissions into infrastructure policy, planning and decisions, and implement measures to reduce embodied carbon in infrastructure, with regard to Infrastructure Australia’s recommendations on reducing embodied carbon.

Construction industry sustainability and market capacity constraints

Changes in the national five-year major public infrastructure pipeline (2023–24 to 2027–28) compared to projections last year (for period 2022–23 to 2026–27) show that:

There is a significant geographical shift in investment to the north, with Queensland and the Northern Territory major public infrastructure pipelines growing by $16 billion, while New South Wales and Victoria have reduced by $39 billion, versus the previous outlook period.

The projected increase in demand for these northern areas would intensify local supply constraints, especially in regional areas where attracting skilled workers is challenging. It is also difficult to source construction materials, plant and equipment due to their geographical distance, adding risk to on-time, on-budget project delivery.

At the national level, current market capacity issues and an inflationary environment are being actively managed. Accounting for the impact of cost escalations, and coupled with a softening of demand, the volume of workers required on the Major Public Infrastructure Pipeline alone has reduced by 20% across 2023–24 to 2027–28 compared to the previous five-year outlook period, helping to close the gap between supply and demand.

There will be a six-fold increase in renewable energy projects across all construction activity in Australia over the next five years, most of which is funded by the private sector. Workforce preparedness is needed to deliver this jump demand for privately funded new energy projects.

Each year, Infrastructure Australia undertakes detailed analysis and demand projections of Australia’s national major public infrastructure pipeline (MPIP) as part of its Market Capacity program. The MPIP covers projects valued over $100 million in New South Wales, Victoria, Queensland and Western Australia, and over $50 million in South Australia, the Australian Capital Territory, the Northern Territory and Tasmania.

The MPIP is currently valued at $213 billion across the 5 years from 2023–24 to 2027–28. This represents an 8% drop in the last 12 months (compared to the demand projection last year for 2022–23 to 2026–27) and follows significant effort by governments to proactively manage infrastructure spending in light of market capacity constraints.

Public spending on major infrastructure works accounts for approximately 25% of the total construction market, estimated at over $1.08 trillion over the five years from 2023–24 to 2027–28. Buildings (62%) dominates the total construction market, followed by transport (17%), utilities (11%) and resources (10%).

Shifts by sector – decline in transport investment offset by growth in buildings and energy

Transport infrastructure remains the largest public infrastructure expenditure category, accounting for 59% of the MPIP ($126 billion) over the five-year outlook (2023–24 to 2027–28). However, transport investment has reduced by 20% on the previous year’s projections, driven by completions of mega-projects in 2023–24, fewer new projects commencing and cost changes for some mega projects in the outlook period.

The decline in public investment in transport is somewhat offset by growth in the other sectors. Buildings infrastructure investment ($71 billion) has grown by 13% and accounts for 34% of the MPIP. While utilities infrastructure investment ($16 billion) has grown by 60% and accounts for 7% of the MPIP. Growth in public utilities investment is driven by new energy projects, especially solar and wind farms.

Cost pressure and movement over time

The cost of construction materials continues to remain high with most materials experiencing year-on-year growth for three straight years. However, the rate of growth appears to have eased over the past twelve months, driven largely by drops in the price for some steel products.

Cost escalations on major infrastructure projects have largely been driven by rising materials cost pressures, which has increased by almost four times higher than labour cost increases over the last three years. Labour accounts for over 60% of costs on a land transport infrastructure construction project compared to under 40% on housing construction project.

Industry reports price escalation of non-labour inputs over the last 12 months of about 10-20%, and hold the view that prices are yet to peak.

Concrete and steel are the construction materials most critical to infrastructure delivery by volume and value, and may be subject to cross-sector competition in the event of supply shortages.

Demand for labour continues to outstrip supply overall, with shortages to be felt more acutely by the energy sector and regional areas

The current infrastructure workforce stands at approximately 198,000 full time equivalent employees and is expected to grow steadily in future. Although there has been a reduction in projected worker shortages (-32,000) by almost 13% (October 2023 compared to October 2024), there is an estimated 197,000 shortfall of infrastructure workers this year. Shortages will prevail across all occupational groups and reflects broad shifts in the MPIP over the five-year outlook:

- By occupations, the engineer shortage is now passed peak demand as more projects move out of planning and design and into construction phase, while shortage of trades workers will continue to grow in future years.

- There will be a jump in labour demand from the private infrastructure sector, which has almost doubled over the last 12 months and is driven by renewable energy projects.

Changes to the size of the infrastructure workforce appears to be largely attributable to workers moving in and out of the construction industry, rather than between construction sectors (for example between infrastructure, housing or commercial/industrial construction). Efforts to grow the total construction workforce will benefit the infrastructure sector.

Nationally, workforce shortages appear to have peaked in capital cities but are projected to rise in regional areas (non-Greater Capital City Statistical Areas), which are expected to almost match current levels in capital cities in 2027. This demand growth is driven by the nation’s energy transition, with the majority (89%) of planned government-funded solar and wind farms to be built in regional areas.

Boosting construction industry productivity provides an opportunity to unlock for capacity

Construction multifactor productivity growth dropped to -0.8% in 2023, a decrease from 0.3% in 2022, continuing a 30-year trend. Boosting construction productivity is essential to delivering Australian governments’ infrastructure ambitions in clean energy, housing, transport and other sectors.

Infrastructure Australia’s 2024 Infrastructure Market Capacity report provides further analysis and advice.

Infrastructure resilience

States and territories have significant, diverse public infrastructure asset bases, which are growing in scale and complexity. Jurisdictions report common issues with underfunded and reactive maintenance, which impacts service delivery, asset lifespans, costs, financial sustainability and the resilience of assets and networks to increasing risks from severe weather and natural hazards.

Funding for new infrastructure is often prioritised over maintenance and renewal. However, many existing assets are ageing and under increasing pressure from constrained public finances, growing and changing demands, modernisation of services and standards, climate change, extreme weather, and the challenge of maintaining dispersed assets across vast geographical areas. Roads, social infrastructure (such as health, education and justice) and public housing feature prominently among ageing asset classes that are priorities for increased maintenance and renewals.

In our 2024 Annual Budget Statement, Infrastructure Australia recommended the Government give greater focus to funding maintenance and renewal of existing infrastructure assets alongside potential new investments. This recognises the growing challenges of ageing assets, maintenance liabilities, infrastructure resilience and the need for a more sustainable funding mix.

At the 2024–25 Budget, the Australian Government committed to progressively increase annual funding for maintaining local roads under the Roads to Recovery Program from $500 million to $1 billion. Under the Federation Funding Agreement Schedule on Land Transport Infrastructure Projects (2024–2029), the Government has also increased its funding to states and territories for maintenance on the National Land Transport Network, from $350 million in 2023–24 to $460 million in 2024–25.

Good asset data and information is critical to effective asset management and prioritisation of maintenance and renewals based on factors such as cost, criticality, performance and risk, but asset data often lacks quality, accuracy and consistency. This creates challenges in understanding risks and the scale or cost of maintenance needs and backlogs, efficiently allocating resources, promoting preventative approaches and making the case to invest in existing assets alongside new assets.

The increasing complexity of asset portfolios, growing demands for public infrastructure and fiscal and market constraints on delivery of new infrastructure to meet demands may strengthen incentives to upgrade and maximise the value of existing assets, evolve asset management policy and practice, and innovate how assets are used to improve efficiency and value.

Infrastructure decarbonisation and embodied carbon

Infrastructure is a major contributor to emissions and Australian, state and territory governments recognise the need to reduce emissions from infrastructure and the built environment to achieve net zero targets. Key areas of priority and action already underway through the infrastructure lifecycle include:

- Embedding consideration of emissions into infrastructure policy, planning and decisions, ensuring that decarbonisation is a key consideration in early project stages (such as the NSW Decarbonising Infrastructure Delivery policy), sustainability assessments for projects and use of sustainability rating tools.

- Driving adoption of low-emission construction materials and reducing more emissions-intensive inputs such as concrete and steel. This includes government procurement levers to create demand and influence markets, and growing domestic production capacity for low carbon materials.

- Incorporating circular economy principles into infrastructure to promote greater resource efficiency, maximise the value of materials and meet future infrastructure needs. This includes increasing uptake and developing markets for sustainable and recycled materials by adopting targets, standards and specifications and applying requirements in design, procurement and delivery.

Infrastructure Australia’s 2024 Embodied Carbon Projections for Australian Infrastructure and Buildings report estimated the amount of upfront embodied carbon in Australia’s pipeline of infrastructure and buildings is forecast to be between 37 Mt CO₂e and 64 Mt CO₂e per year in the five years to 2026–27. These emissions account for 7% of Australia’s national emissions, with most of these emissions coming from the manufacture of construction materials.

The report presents practical strategies and recommendations to support infrastructure and built environment decarbonisation. These include switching to lower-carbon building materials and construction technologies, such as green steel or aluminium produced with 100% renewable electricity, as well as changing the way infrastructure and building projects are planned, designed and delivered to embed considerations of decarbonisation early.

Adopting the strategies and recommendations in the report would mean that, by 2026–27, Australia can reduce upfront emissions from the five-year construction pipeline by 23% at no additional cost. This is equivalent to a reduction of 9 Mt CO₂e – roughly 2% of Australia’s gross national greenhouse gas emissions in 2022–23.

List of sources

Australian Bureau of Statistics, Building Activity, Australia, Table 38. Number of Dwelling Unit Completions by Sector, States and Territories, 2024, www.abs.gov.au/statistics/industry/building-and-construction/building-activity-australia/latest-release#number-of-dwellings-completed

ACT Government, ACT Infrastructure Plan Update, www.builtforcbr.act.gov.au/infrastructure-plan

Australian Energy Market Operator, 2024 Electricity Statement of Opportunities, 2024, https://aemo.com.au/-/media/files/electricity/nem/planning_and_forecasting/nem_esoo/2024/2024-electricity-statement-of-opportunities.pdf?la=en&hash=2B6B6AB803D0C5F626A90CF0D60F6374

Australian Energy Market Operator, Renewable Energy Zones, 2024, www.aemo.com.au/-/media/files/major-publications/isp/2024/appendices/a3-renewable-energy-zones.pdf?la=en

Australian Government, Budget 2024-25, Budget Measures: Budget Paper No.2, 2024, available at: www.budget.gov.au/content/bp2/download/bp2_2024-25.pdf

Australian Government, Capacity Investment Scheme, www.dcceew.gov.au/energy/renewable/capacity-investment-scheme

Australian Government, Clean Energy Finance Corporation, www.cefc.com.au/

Australian Government, Federation Funding Agreement Schedule for Land Transport Infrastructure Projects (2024-2029), www.federalfinancialrelations.gov.au/agreements/land-transport-infrastructure-projects-2024-2029

Australian Government, Housing Support Program, www.infrastructure.gov.au/territories-regions-cities/cities/housing-support-program

Australian Government, Hydrogen Headstart program, www.dcceew.gov.au/energy/hydrogen/hydrogen-headstart-program

Australian Government, Infrastructure Investment Program, www.investment.infrastructure.gov.au/about

Australian Government, Infrastructure Investment Program – Targeted Road Safety Programs, Budget 2024-25, www.investment.infrastructure.gov.au/sites/default/files/documents/national-subprogram-overview-budget-2024-25-fact-sheet-building-australia.pdf

Australian Government, Infrastructure Policy Statement, www.infrastructure.gov.au/sites/default/files/documents/infrastructure-policy-statement-20231114.pdf

Australian Government, National Agreement on Closing the Gap, www.closingthegap.gov.au/national-agreement

Australian Government, National Climate Risk Assessment, www.acs.gov.au/pages/national-climate-risk-assessment

Australian Government, National Freight and Supply Chain Strategy, www.freightaustralia.gov.au/

Australian Government, National Housing Accord, www.treasury.gov.au/policy-topics/housing/accord

Australian Government, National Productivity Fund, www.ministers.treasury.gov.au/ministers/jim-chalmers-2022/speeches/address-australian-business-economists

Australian Government, National Reconstruction Fund, www.nrf.gov.au/

Australian Government, National Urban Policy, 2024, www.infrastructure.gov.au/department/media/publications/national-urban-policy

Australian Government, National Water Grid Fund and Investment Framework, www.nationalwatergrid.gov.au/

Australian Government, Net Zero by 2050, www.dcceew.gov.au/climate-change/emissions-reduction/net-zero

Australian Government, Regional Investment Framework, 2023, www.infrastructure.gov.au/territories-regions-cities/regional-australia/regional-investment-framework

Australian Government, Resourcing Australia’s Prosperity, www.ga.gov.au/scientific-topics/resourcing-australias-prosperity

Australian Government, Rewiring the Nation, available at: https://www.dcceew.gov.au/energy/renewable/rewiring-the-nation

Australian Government, Telecommunications in new developments policy, 2024, http://www.infrastructure.gov.au/department/media/publications/2024-telecommunications-new-developments-policy

Australian Government, Third Runway Major Development Plan—Melbourne Airport—Conditions of Approval, 2024, www.infrastructure.gov.au/department/media/publications/third-runway-major-development-plan-melbourne-airport-conditions-approval-10-september-2024

Infrastructure Australia, 2024 Embodied Carbon Projections for Australian Infrastructure and Buildings Report, www.infrastructureaustralia.gov.au/embodied-carbon-projections

Infrastructure Australia’s Infrastructure Market Capacity 2024 Report, www.infrastructureaustralia.gov.au/infrastructure-market-capacity-program

Infrastructure Northern Territory, NT Infrastructure Plan & Pipeline, 2022, dipl.nt.gov.au/industry/nt-infrastructure-plan-and-pipeline

Infrastructure Northern Territory, NT Infrastructure Strategy 2022-2030, 2022, www.dli.nt.gov.au/strategies/nt-infrastructure-strategy-2022-to-2030

Infrastructure NSW, 2023-24 State Infrastructure Plan, 2023, www.infrastructure.nsw.gov.au/media/vetcpbb1/infr10125-state-infrastructure-plan-2023-24.pdf

Infrastructure NSW, Decarbonising Infrastructure Delivery policy, 2024, www.infrastructure.nsw.gov.au/expert-advice/decarbonising-infrastructure-delivery/

Infrastructure NSW, NSW State of Infrastructure Report, 2023, www.infrastructure.nsw.gov.au/media/oznlnai5/insw-state-of-infrastructure-report-2022-23.pdf

Infrastructure NSW, Staying Ahead: State Infrastructure Strategy 2022-2042, 2022, available at: https://sis2022.infrastructure.nsw.gov.au/

Infrastructure SA Capital Intentions Statement, 2023, www.infrastructure.sa.gov.au/our-work/capital-intentions

Infrastructure Western Australia, Foundations for a Stronger Tomorrow: State Infrastructure Strategy, 2022, www.infrastructure.wa.gov.au/foundations-stronger-tomorrow-state-infrastructure-strategy

NSW Government, NSW Budget: Social Housing and Homelessness Investment, 2024, www.nsw.gov.au/media-releases/nsw-budget-social-housing-and-homelessness-investment

NSW Government, NSW Regional Plans, www.planning.nsw.gov.au/plans-for-your-area/regional-plans

Northern Territory Government, NT Infrastructure Audit, 2023, //dipl.nt.gov.au/strategies/nt-infrastructure-audit

Queensland Government, Queensland Regional Plans, www.planning.qld.gov.au/planning-framework/plan-making/regional-planning

Queensland Government, State Infrastructure Strategy, 2022, www.statedevelopment.qld.gov.au/__data/assets/pdf_file/0013/72103/state-infrastructure-strategy-2022.pdf

SA Government, South Australian Economic Statement 2023, //www.premier.sa.gov.au/south-australian-economic-statement

SA Government, South Australia’s Freight and Supply chain strategy, 2024, https://www.dit.sa.gov.au/__data/assets/pdf_file/0003/1371027/DIT-SA-Freight-and-Supply-Chain-Strategy-2024-06.pdf

SA Government, South Australia’s 20-Year State Infrastructure Strategy Discussion Paper, 2023, www.yoursay.sa.gov.au/state-infrastructure-strategy-url

Tasmanian Government, Keeping Hobart Moving, 2023, www.keepinghobartmoving.tas.gov.au/__data/assets/pdf_file/0011/466715/Keep_Hobart_Moving_Transport_Solutions_for_Our_Future.pdf

The Senate, Select Committee on Adopting Artificial Intelligence, 2024, https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Adopting_Artificial_Intelligence_AI/AdoptingAI/Report

The Treasurer, the Hon Dr Jim Chalmers MP, Address to the Australian Business Economists, 2024, www.ministers.treasury.gov.au/ministers/jim-chalmers-2022/speeches/address-australian-business-economists

Victorian Government, Victorian Infrastructure Plan 2021, www.dtf.vic.gov.au/victorian-infrastructure-plan-2021

Victorian Government, Victoria’s Infrastructure Strategy 2021-2051 (Volumes 1 & 2), 2021, Infrastructure Victoria, www.infrastructurevictoria.com.au/infrastructure-strategy

Western Australian Government, State Infrastructure Strategy – Foundations for a stronger tomorrow: WA Government Response, 2023, www.wa.gov.au/government/publications/state-infrastructure-strategy-foundations-stronger-tomorrow-wa-government-response-2023