Introduction

Infrastructure funding and financing is an issue often misunderstood—so I'm glad to see a conference dedicated to unravelling the subject.

With Government budgets under significant constraint, it is important that we plan effectively to ensure that when we spend large sums of money on infrastructure we build the right projects, at the right time, for the right price.

But we also need to consider not just how we prioritise investment but also how we fund the payment of our major transport, telecommunication, energy and water infrastructure.

I will discuss both of these issues in turn today to help illuminate first; how infrastructure investment should be prioritised and the common problems this investment is trying to solve; and second, how we should approach and think about reforming our current infrastructure funding model.

Infrastructure Priority List

A key part of our role as a national advisory body is to help Australian governments make informed, evidence-based decisions to invest in projects that will best meet our future infrastructure needs.

We do this through the Infrastructure Priority List. The List is a prioritised list of nationally significant investments. It provides decision makers with advice and guidance on specific infrastructure investments that will underpin Australia's continued prosperity.

One of the great advantages of the List is that it's a living document—it is regularly updated as we assess and receive new business cases and initiative data.

Adding a project to the List means that Infrastructure Australia's independent Board has positively assessed a full business case for the project, that it is nationally significant, has strategic merit and that we are confident that it will have economic, environmental and social benefits.

Of course, not all prospective infrastructure investments are at the same stage of development. The Priority List also includes initiatives, which are proposals that have been identified to potentially address a nationally-significant problem, but require further development and rigorous assessment to determine if they are the most appropriate solution.

By including initiatives alongside more advanced projects which have a fully developed business case, we are supporting a culture of long-term infrastructure planning and a more sophisticated approach to business case development.

The Infrastructure Priority List also gives long-term confidence to governments and investors.

For investors, knowing that all levels of Australian government are in agreement about the relative importance of a particular infrastructure project or the need to develop a solution to an identified problem, can be an enormous benefit.

For our political leaders, the Infrastructure Priority List is the central source of informed analysis on our most pressing infrastructure needs, and provides a catalogue of projects prioritised for state and federal funding.

Key IPL themes

There are over 100 projects and initiatives on the IPL, but it might be useful to discuss the types of problems these projects are trying to solve.

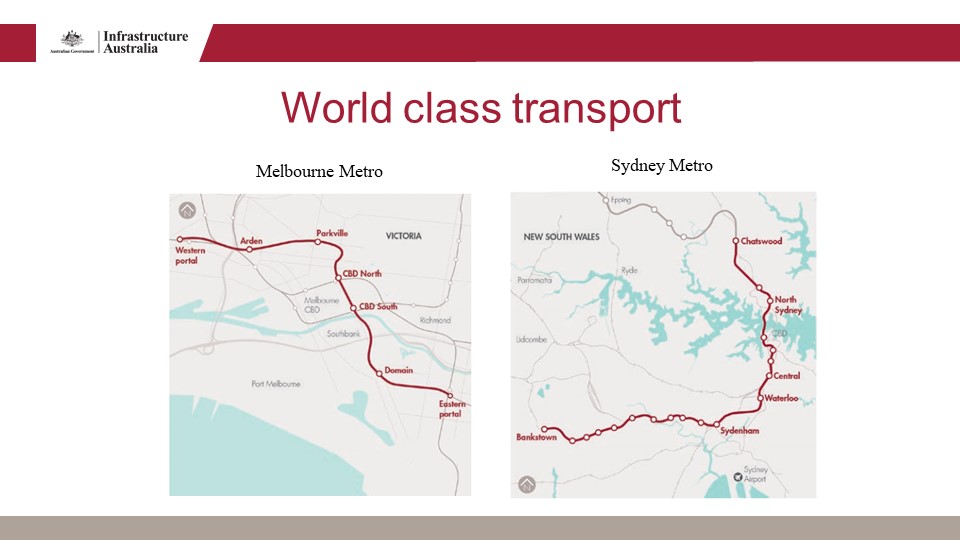

The first is prioritising investment in world-class public transport systems.

To support growth in our cities and regions and enable our economy to thrive, we need to significantly increase network capacity and deliver reliable and efficient services appropriate for a 21st century population and built environment.

That means working towards delivering high-frequency, integrated passenger transit systems—like Melbourne and Sydney Metro—that enable people to get to and from work easily, ensures businesses can operate efficiently and supports the creation of dynamic communities.

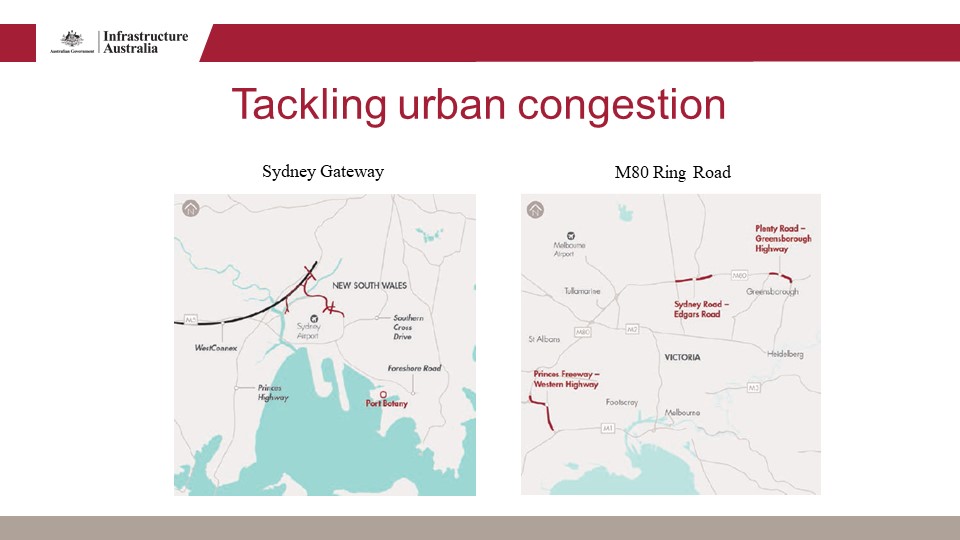

The second priority is tackling urban congestion.

The Australian Infrastructure Audit found that without action to increase capacity on our transport networks and better manage supply, congestion could cost the economy $53 billion per year by 2031.

To meet these challenges, the Priority List includes a number of projects—such as Sydney Gateway and the M80 Ring Road Upgrade—that are intended to alleviate bottlenecks and capacity constraints along critical road arteries.

Continued investment in congestion-busting transport projects must be an ongoing focus for Australian governments if we are to reduce delays and improve the productivity of our major cities.

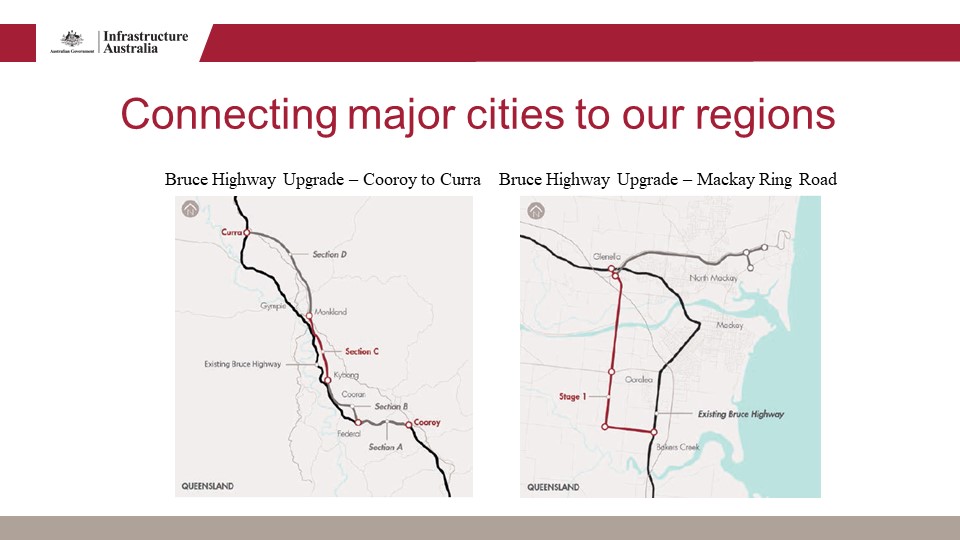

The third priority is connecting major cities to our regions.

Australia's regions already contribute substantially to the nation's growth and prosperity, produces many of our key exports such as minerals, energy, agriculture and tourism.

We need to focus our future infrastructure investment on supporting access to and growth in our regions and continue to develop business cases for projects that offer the most return nation-wide.

Developing efficient, liveable and productive regional hubs should be a key priority. Better connected regions will not only facilitate economic growth, provide people with more opportunities to live and work outside our capital cities. The Bruce Highway Upgrade is a good example of this.

The fourth priority is streamlining our freight supply network.

Australia's proximity to the booming economies of China and South East Asia, combined with our reputation for high quality exports, means there are enormous opportunities for export-oriented Australian businesses which our freight and supply chains need to support.

The Priority List includes a number of important freight projects, while also identifying development of National Freight and Supply Chain Strategy as a High Priority Initiative.

This was also a key reform recommendation in the Australian Infrastructure Plan, which is now being progressed by the Federal Government. A national panel of industry experts has been established to assist with the development of this strategy and is expected to present a draft report to the Government later this year.

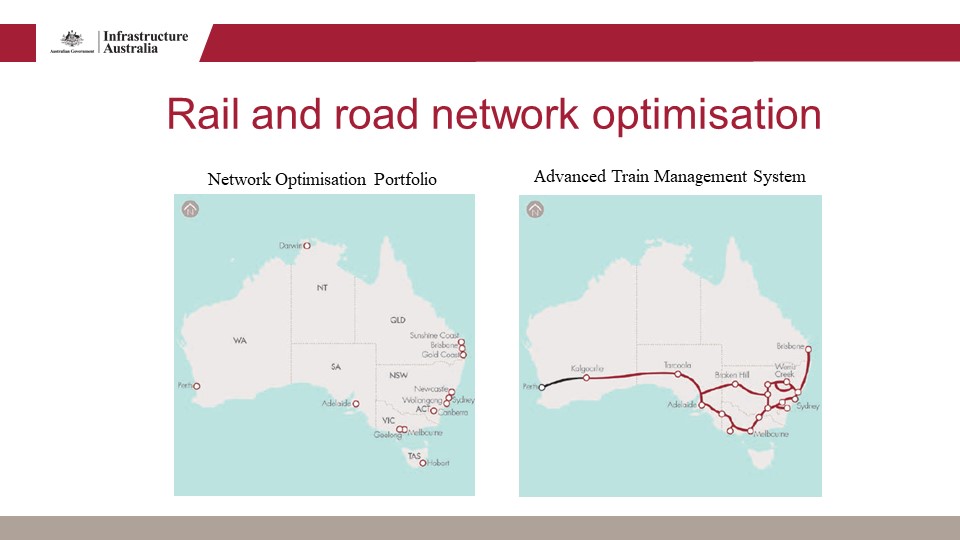

And finally, we need to prioritise investment that optimises our rail and road network infrastructure.

Investing in new infrastructure is important, but getting the best out of existing assets can help us go a long way too.

We need to ensure that existing infrastructure is used more efficiently, with a focus on maintenance and the use of new technology, including sensors and data analytics, to secure service improvements.

In the Priority List, we recommend that embedding technology in existing infrastructure can provide operators with rich data on network performance and use. Small targeted investments can drive significant improvements in efficiency and reliability, and deliver better outcomes for Australian infrastructure users.

Reforming our infrastructure funding model

These investment priorities are multi-decade in nature, meaning we need to carefully consider how we fund not just the upfront costs of our nationally significant infrastructure, but also the whole asset lifecycle, which includes maintenance, operation, and renewal.

At this point I'd like to distinguish between infrastructure funding and financing, as they are often used interchangeable.

Funding refers to how infrastructure is paid for. Ultimately, there are only two sources of funding for infrastructure, either taxpayers through government spending or directly by users, such as through electricity charges or road tolls.

Financing refers to the supply of capital, such as loans and equity, used to pay for the upfront investment costs of an infrastructure project. The sources of funding are then used to pay back the money raised through the initial financing.

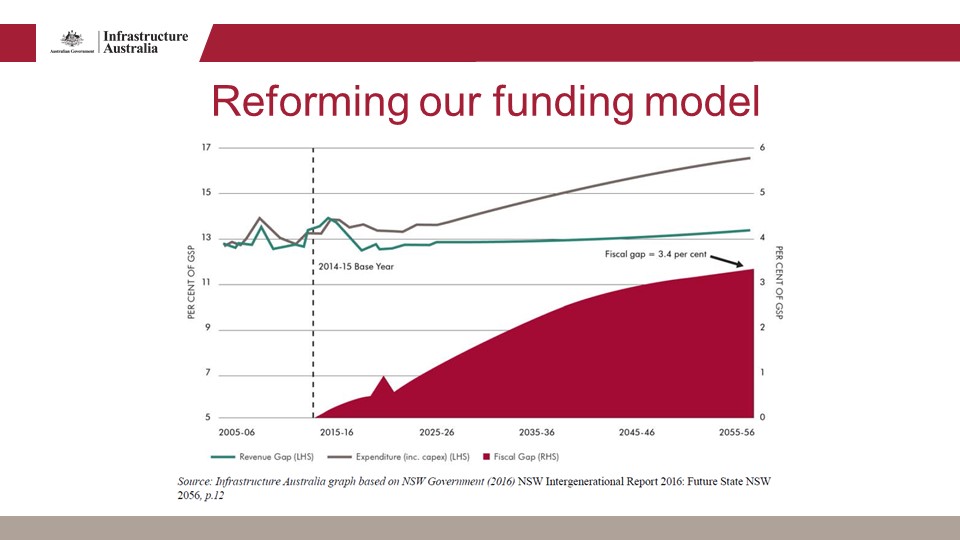

In Australia, we don't have a problem financing our infrastructure, our challenge is actually in funding it. Australia's ageing and growing population sees governments under pressure to fund health and welfare services, in turn placing pressure on funding of other infrastructure needs.

Up until now we have primarily relied upon the traditional Commonwealth grant funding model, drawn from general taxation and supplemented by user charges.

This approach has worked relatively well to deliver the high-quality infrastructure Australians enjoy today, but with budgets under constraint we now need to find new ways of diversifying the available sources of funding.

Because there are only two sources of funding—taxpayers and users—we need to reconfigure the balance between those who directly benefit from infrastructure and broader taxpayers.

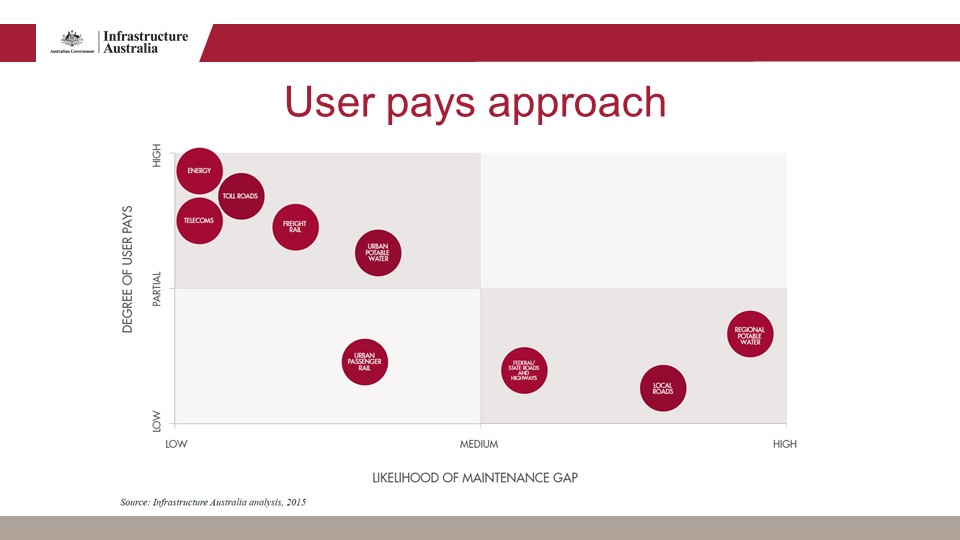

Across Australia's four primary economic infrastructure sectors (energy, telecommunications, water and transport) there is a mix of user pays and taxpayer funding.

In energy and telecommunications, the provision of services, and the networks upon which they are delivered (the poles and wires of the electricity network, gas grids and fixed-line and mobile telecommunications networks), are paid for by user charges.

In both these sectors, the charges levied on customers largely reflect each user's own level of consumption.

These market structures provide price signals to users that reflect the cost of supply, and communicate the demand profile back to infrastructure providers.

Notwithstanding the Australian Government's substantial investment in telecommunications through the NBN, the market and regulatory settings in the sector are generally efficient and provide good-quality outcomes for users.

For potable water and wastewater services (particularly in metropolitan areas) infrastructure is largely funded by user charges.

Users pay for the provision of infrastructure through a combination of access or connection charges and (for some customers) a consumption charge based on how much water they use.

The transport sub-sectors also demonstrate mixed approaches to user pays. On the one hand, aviation, ports and freight rail have a strong link between usage and charging in an independent economic regulatory framework.

On the other, the road network and public transport system have comparatively weak links (with the notable exception of urban toll roads).

In these cases, the absence of user pays means the taxpayer remains directly involved in funding infrastructure across inception, planning, delivery and operations.

User pays approach

Moving to a user pays approach is also appealing because there is a strong link between the degree of user pays and the quality of maintenance outcomes.

Those sectors which have the most advanced user pays frameworks also have the lowest likelihood of maintenance gaps.

Those sectors where costs are met largely by taxpayers have the highest likelihood of systemic maintenance failings.

There is a causal link between maintenance outcomes and the funding balance between users and taxpayers which adds weight to the argument that infrastructure best supports strong customer outcomes when it is underpinned by a user pays model.

As such, the most appropriate and sustainable structural solution to the maintenance deficit in public infrastructure is a transition to a user pays model.

Maintenance outcomes are demonstrably better in infrastructure sectors where funding is derived from users rather than taxpayers; meaning transition to a predominantly user pays model is a logical mechanism to deliver a more sustainable funding platform for maintenance.

Conclusion

Clearly, if we are to find more sustainable and equitable ways of funding the infrastructure Australia needs, we need to diversify our funding base and rebalance towards a user pays system.

This is a multi-sector reform challenge that won't come easy. As leaders in infrastructure, you should demand a higher standard of governance when it comes to the planning and funding of our major public infrastructure. Because without your voices we may never see reform happen.

Thank you.